All Categories

Featured

Table of Contents

That typically makes them a more budget friendly choice for life insurance policy protection. Numerous individuals obtain life insurance protection to help monetarily shield their liked ones in instance of their unexpected fatality.

Or you may have the choice to convert your existing term protection into an irreversible policy that lasts the rest of your life. Different life insurance policy plans have possible advantages and downsides, so it's essential to recognize each prior to you determine to purchase a plan.

As long as you pay the premium, your beneficiaries will certainly obtain the survivor benefit if you die while covered. That stated, it is necessary to note that many policies are contestable for 2 years which indicates coverage might be rescinded on fatality, ought to a misstatement be located in the application. Plans that are not contestable frequently have a graded death advantage.

Costs are usually lower than whole life policies. You're not locked into a contract for the remainder of your life.

And you can not pay out your plan during its term, so you will not receive any economic benefit from your past coverage. As with other kinds of life insurance policy, the cost of a level term policy depends on your age, coverage demands, work, lifestyle and wellness. Commonly, you'll discover a lot more economical coverage if you're younger, healthier and much less risky to guarantee.

Proven Term Life Insurance With Accidental Death Benefit

Considering that level term costs remain the same for the period of insurance coverage, you'll know specifically how much you'll pay each time. Level term protection also has some adaptability, permitting you to personalize your plan with additional functions.

You might have to satisfy details conditions and qualifications for your insurance firm to pass this biker. In addition, there might be a waiting duration of approximately 6 months prior to taking effect. There additionally can be an age or time frame on the protection. You can add a kid motorcyclist to your life insurance coverage policy so it likewise covers your children.

The fatality advantage is generally smaller, and coverage typically lasts until your youngster transforms 18 or 25. This biker might be an extra affordable way to help ensure your children are covered as bikers can typically cover several dependents at the same time. As soon as your child ages out of this coverage, it may be feasible to convert the motorcyclist right into a brand-new plan.

When contrasting term versus irreversible life insurance. term life insurance for couples, it's important to remember there are a couple of various types. One of the most usual kind of irreversible life insurance policy is entire life insurance, yet it has some essential distinctions compared to level term insurance coverage. Here's a basic introduction of what to take into consideration when comparing term vs.

Entire life insurance policy lasts permanently, while term insurance coverage lasts for a details period. The costs for term life insurance are usually less than whole life insurance coverage. With both, the costs remain the exact same for the period of the policy. Entire life insurance policy has a cash money worth element, where a part of the premium may grow tax-deferred for future demands.

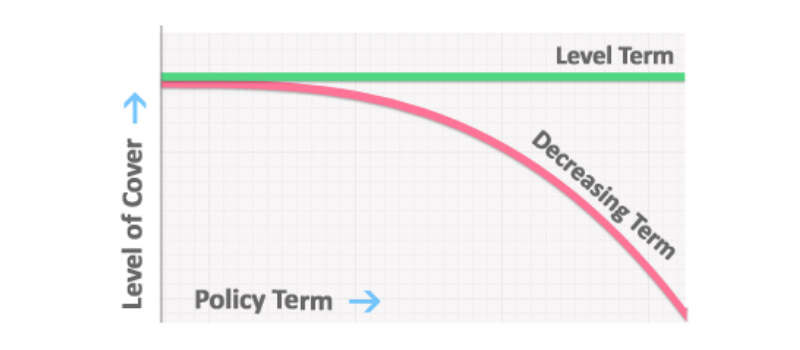

One of the primary functions of degree term coverage is that your costs and your fatality advantage don't transform. You may have coverage that begins with a fatality advantage of $10,000, which might cover a mortgage, and then each year, the fatality advantage will decrease by a collection amount or portion.

Because of this, it's typically a much more inexpensive kind of degree term coverage. You might have life insurance coverage with your company, yet it might not be enough life insurance policy for your requirements. The initial step when buying a plan is identifying just how much life insurance coverage you require. Take into consideration factors such as: Age Family dimension and ages Employment standing Revenue Financial obligation Way of life Expected last expenditures A life insurance coverage calculator can aid identify how much you need to start.

After determining on a policy, finish the application. If you're approved, authorize the documentation and pay your initial costs.

Renowned Level Term Life Insurance Definition

You may want to upgrade your beneficiary details if you have actually had any type of substantial life changes, such as a marital relationship, birth or divorce. Life insurance policy can sometimes really feel difficult.

No, degree term life insurance policy does not have money worth. Some life insurance policy policies have a financial investment function that allows you to develop money worth gradually. A part of your premium repayments is established apart and can gain interest in time, which grows tax-deferred during the life of your insurance coverage.

These plans are typically considerably more pricey than term coverage. If you reach completion of your policy and are still active, the protection ends. You have some choices if you still desire some life insurance coverage. You can: If you're 65 and your coverage has actually run out, for example, you may wish to get a brand-new 10-year degree term life insurance policy policy.

Secure Level Term Life Insurance Definition

You may be able to transform your term insurance coverage right into a whole life plan that will certainly last for the remainder of your life. Lots of types of degree term policies are convertible. That suggests, at the end of your insurance coverage, you can convert some or every one of your policy to entire life coverage.

Level term life insurance policy is a policy that lasts a set term normally in between 10 and three decades and comes with a level death benefit and level costs that stay the exact same for the entire time the plan is in result. This suggests you'll know precisely just how much your repayments are and when you'll need to make them, enabling you to spending plan as necessary.

Level term can be a fantastic alternative if you're wanting to get life insurance policy coverage for the very first time. According to LIMRA's 2023 Insurance coverage Barometer Research Study, 30% of all grownups in the United state requirement life insurance policy and don't have any type of type of plan. Level term life is predictable and cost effective, which makes it among one of the most popular types of life insurance policy.

Latest Posts

Funeral Burial Insurance Policy

Nationwide Funeral Plans

Difference Between Life Insurance And Funeral Plan