All Categories

Featured

Table of Contents

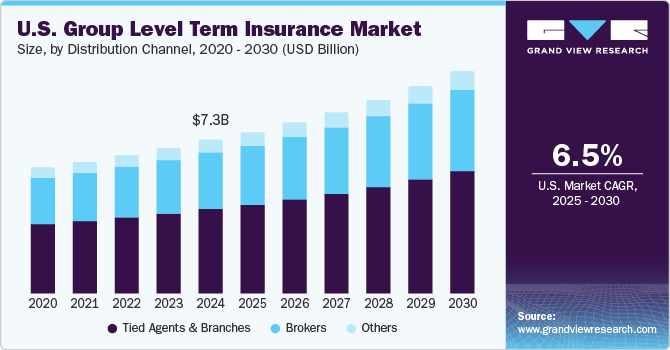

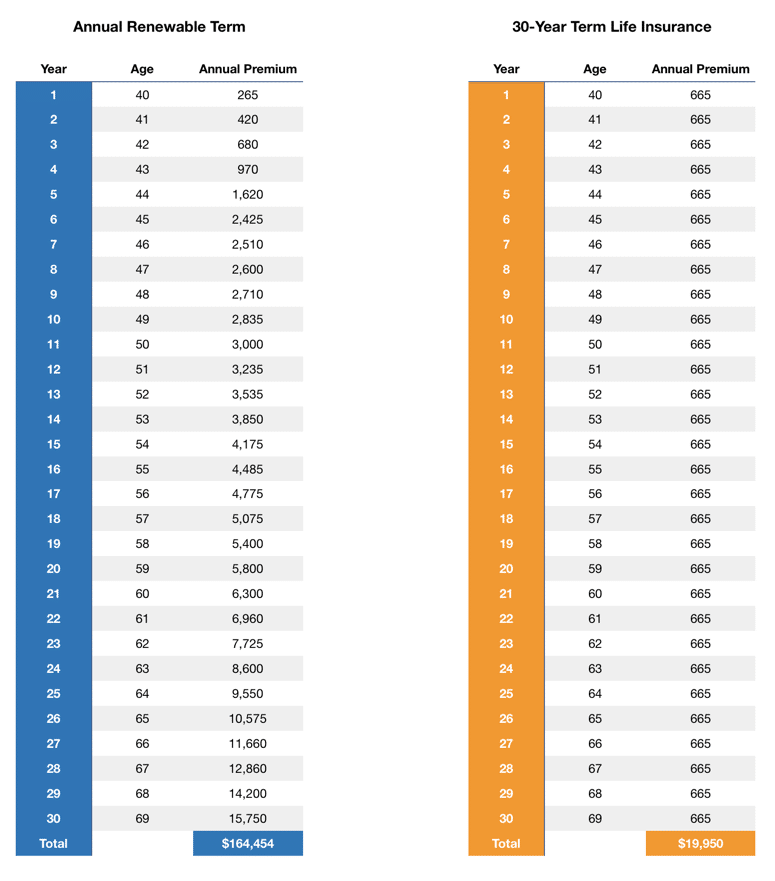

A level term life insurance policy can provide you satisfaction that individuals that depend upon you will certainly have a survivor benefit during the years that you are preparing to support them. It's a way to help deal with them in the future, today. A level term life insurance policy (occasionally called level premium term life insurance) plan provides protection for a set number of years (e.g., 10 or twenty years) while keeping the costs repayments the same throughout of the plan.

With degree term insurance policy, the price of the insurance will certainly remain the same (or potentially lower if dividends are paid) over the term of your policy, typically 10 or two decades. Unlike permanent life insurance coverage, which never ever runs out as lengthy as you pay costs, a level term life insurance policy plan will certainly finish at some time in the future, commonly at the end of the duration of your degree term.

What is Increasing Term Life Insurance? Learn the Basics?

As a result of this, many individuals use permanent insurance policy as a secure financial planning device that can serve many requirements. You might be able to convert some, or all, of your term insurance throughout a collection period, typically the very first one decade of your plan, without requiring to re-qualify for protection also if your health has changed.

As it does, you may want to add to your insurance policy coverage in the future - Term life insurance level term. As this takes place, you may want to eventually minimize your death advantage or take into consideration transforming your term insurance to a long-term plan.

As long as you pay your costs, you can rest easy understanding that your enjoyed ones will certainly obtain a survivor benefit if you pass away throughout the term. Numerous term policies permit you the capability to transform to irreversible insurance policy without having to take an additional wellness test. This can enable you to take advantage of the fringe benefits of a permanent plan.

Level term life insurance policy is among the simplest courses right into life insurance policy, we'll go over the advantages and downsides so that you can choose a plan to fit your demands. Level term life insurance coverage is one of the most usual and fundamental form of term life. When you're searching for short-lived life insurance policy strategies, level term life insurance coverage is one course that you can go.

The application procedure for degree term life insurance policy is typically extremely straightforward. You'll submit an application that has general individual info such as your name, age, and so on in addition to a more thorough survey regarding your case history. Relying on the policy you have an interest in, you may have to participate in a medical exam process.

The short response is no., for instance, let you have the convenience of death benefits and can build up cash worth over time, implying you'll have a lot more control over your advantages while you're to life.

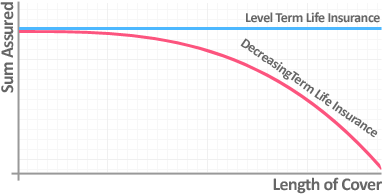

What Is Decreasing Term Life Insurance? A Complete Guide

Motorcyclists are optional provisions added to your policy that can give you additional advantages and defenses. Anything can happen over the course of your life insurance term, and you want to be prepared for anything.

There are circumstances where these advantages are built into your policy, yet they can also be offered as a separate addition that requires extra repayment.

Latest Posts

Funeral Burial Insurance Policy

Nationwide Funeral Plans

Difference Between Life Insurance And Funeral Plan