All Categories

Featured

Table of Contents

It allows you to budget plan and strategy for the future. You can quickly factor your life insurance policy into your budget plan because the costs never ever transform. You can prepare for the future just as quickly because you recognize precisely just how much money your liked ones will certainly get in the occasion of your lack.

In these cases, you'll usually have to go through a brand-new application process to obtain a better rate. If you still need coverage by the time your degree term life plan nears the expiration date, you have a few choices.

Most level term life insurance plans include the alternative to renew protection on an annual basis after the preliminary term ends. which of these is not an advantage of term life insurance. The price of your plan will be based upon your existing age and it'll boost each year. This could be a good alternative if you only require to prolong your coverage for one or 2 years or else, it can obtain expensive pretty swiftly

Degree term life insurance is one of the most inexpensive insurance coverage options on the marketplace due to the fact that it provides basic protection in the form of fatality advantage and just lasts for a collection time period. At the end of the term, it ends. Entire life insurance policy, on the various other hand, is substantially extra pricey than degree term life since it does not expire and comes with a cash money worth function.

Family Protection Level Term Life Insurance

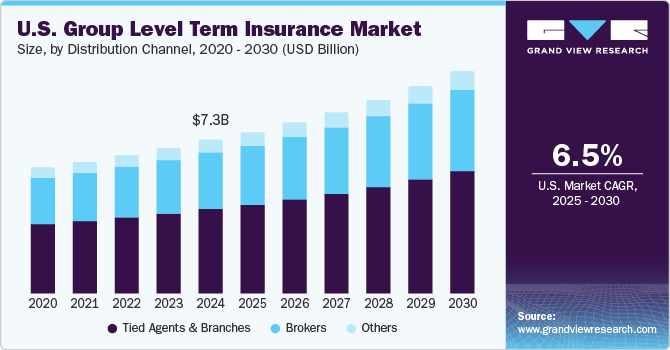

Rates may differ by insurance company, term, insurance coverage quantity, health class, and state. Not all plans are offered in all states. Price image valid as of 10/01/2024. Degree term is a great life insurance policy alternative for most individuals, but depending upon your insurance coverage demands and personal situation, it could not be the very best suitable for you.

Annual renewable term life insurance has a regard to just one year and can be restored yearly. Annual renewable term life premiums are originally less than level term life costs, yet costs rise each time you renew. This can be a good option if you, as an example, have just give up smoking and need to wait 2 or three years to get a degree term plan and be eligible for a lower rate.

Reliable Term To 100 Life Insurance

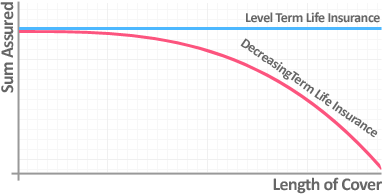

With a lowering term life policy, your death advantage payout will certainly lower with time, but your payments will remain the very same. Decreasing term life plans like mortgage protection insurance generally pay out to your loan provider, so if you're seeking a policy that will certainly pay out to your enjoyed ones, this is not a great fit for you.

Raising term life insurance coverage plans can help you hedge against rising cost of living or strategy monetarily for future kids. On the various other hand, you'll pay more upfront for much less coverage with an increasing term life plan than with a level term life plan. If you're uncertain which kind of plan is best for you, dealing with an independent broker can assist.

When you've decided that level term is ideal for you, the next step is to acquire your policy. Right here's how to do it. Compute just how much life insurance policy you need Your protection amount need to attend to your family members's long-lasting financial needs, consisting of the loss of your earnings in case of your fatality, in addition to financial debts and daily expenses.

A level costs term life insurance strategy allows you stick to your budget plan while you help protect your household. ___ Aon Insurance Coverage Solutions is the brand name for the brokerage firm and program management procedures of Fondness Insurance policy Services, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Coverage Agency, Inc. (CA 0795465); in Okay, AIS Affinity Insurance Coverage Services Inc.; in CA, Aon Fondness Insurance Providers, Inc.

The Plan Representative of the AICPA Insurance Coverage Trust Fund, Aon Insurance Solutions, is not affiliated with Prudential.

Latest Posts

Funeral Burial Insurance Policy

Nationwide Funeral Plans

Difference Between Life Insurance And Funeral Plan